RESOURCES

Useful materials, templates, and books for game company founders.

This template includes all the information Investors need to see.

Please note: this format is not a requirement from TGF and is just an example. Please feel free to use any pitch deck format that suits you the best.

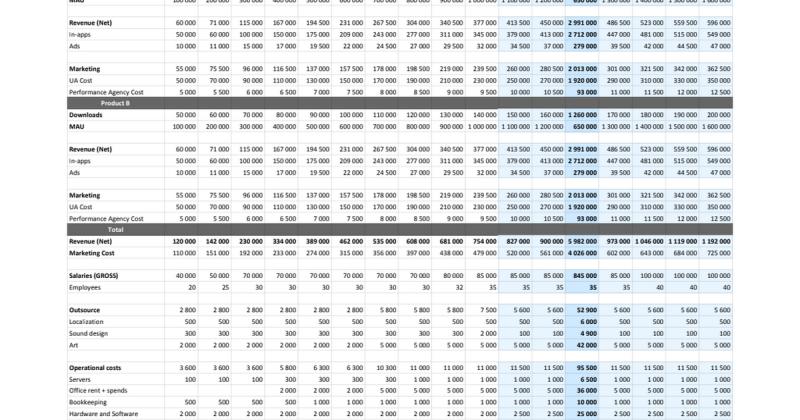

During the Due Diligence process, you could be asked to provide PnL and here you can find an example of how to create and maintain it.

It could be useful when you are talking with the investor as well as for internal usage. Please note, that it is not suitable for audit, as your auditor could require some specific format.

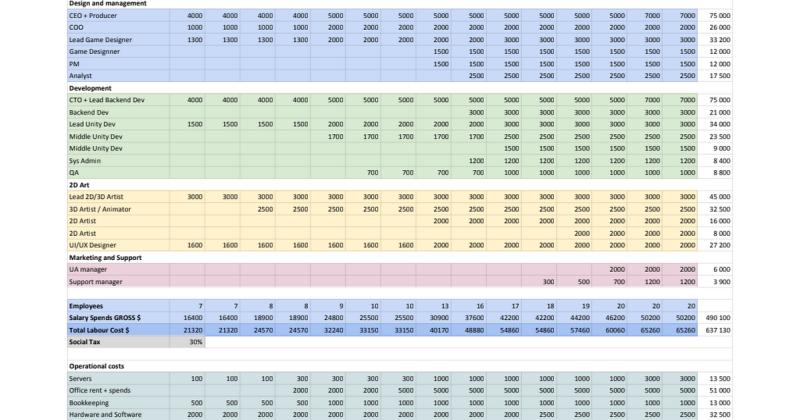

How many people do you need to create a game and how to calculate how much would it cost? Here is the template of the studio budget you can use to calculate the game company budget, estimate the hiring plan, and justify how much money you need to raise.

How do venture capital deals come together? This is one of the most frequent questions asked by each generation of new entrepreneurs. Surprisingly, there is little reliable information on the subject. This great book shows fledgling entrepreneurs the inner-workings of the VC process, from the venture capital term sheet and effective negotiating strategies to the initial seed and the later stages of development.

Every business, every artist, every person looking to promote themselves and their work wants to know what makes some works so successful while others disappear. Hit Makers is a magical mystery tour through the last century of pop culture blockbusters and the most valuable currency of the twenty-first century—people’s attention.

Creativity, Inc. is a manual for anyone who strives for originality and the first-ever all-access trip into the nerve center of Pixar Animation - into the meetings, postmortems, and “Braintrust” sessions where some of the most successful films in history are made. It is, at heart, a book about creativity - but it is also, as Pixar cofounder and president Ed Catmull writes, “an expression of the ideas that I believe make the best in us possible”.

Founders and investors on how to start, run and grow a games company. In a nutshell, this is a podcast about the founders and investors who are building the games companies of the future.

The Metacast by Naavik is a business-focused exploration of the companies, trends, strategies and leaders that are defining the future of games.

Deconstructor of Fun podcast is created by games professionals for games professionals. We explore the business side of the games industry with the goal of bringing listeners content that is relevant, insightful, and entertaining.

Learn what game to develop next by discovering the less competitive market segments. AppMagic is an affordable alternative to expensive tools.

Aggregates and stores all the relevant data on gaming venture capital, public offerings, and merge and acquisition deals. Dates, deal sizes, deal types.

FAQ

Where are you based?

The Games Fund offices are based in New York, Los Angeles, and Cyprus.

What kind of companies is TGF investing in?

TGF is investing in early-stage gaming startups, mobile and PC/console developers, and game-tech companies: tools, services, everything that makes the life of game developers easier and players’ experience better. We do not invest in blockchain, real-money gambling, and adult games.

The earliest stage for us is the concept stage. We need founders to have the idea for their company and the game/service they want to build. We do not invest in “ideas research.” As soon as you find that brilliant idea, did market research, and have a core team to kickstart the development - ping us!

What is your check size, and how much equity do you take?

Usually, we invest $500k-$2m as an initial investment and are ready to follow on. If you are raising a bigger round, we would be happy to co-invest with other VC funds.

Valuation in the early stages is entirely subjective, and every single deal is unique.

But we have some principles. We never take control stake in our portfolio companies, and we prefer founders to keep control during our partnership and further rounds of financing.

We prefer long profits and will find and explain the deal terms that we believe are fair for this deal.

What is your target geography?

TGF invests globally, but our primary focus is on gaming companies in the United States, Europe, Baltic Countries, Turkey, and Israel. But if your company is based somewhere else, it would not be a dealbreaker, and we will also assess this opportunity.

What kind of games are you looking for?

We are genre-agnostics and have a diversified experience from casual to midcore to hardcore.

We have our preferences and opinions as we constantly analyze the ever-changing games market, but if you believe in your vision and have insights - we will be happy to hear about it.

One important thing: We value artistic expression and impactful games as players, but as a fund, we invest in commercially motivated and ambitious developers who dream big.

Are you investing in companies or projects?

We invest in founders in the first place! We believe that VC funding is a long-term relationship, and we can give more as a partner. That’s why we prefer to invest in companies.

What if we failed?

That’s a venture risk, and we will share it with the founders. Our investment is not a bank loan, and if you failed - we failed together. You don’t have to return the investment.

That is why we invest in founders and the team. Sometimes the company needs a second chance, and we believe that mistakes and failures are an essential part of the journey to success. One just has to learn from them and use that experience to pivot and try once again.

Will you make product or business decisions and tell us what to do?

Never. We invest in founders who know what they want to create, which we 100% believe in.

It is better to check if our visions are aligned before the deal and then let founders do what they do best - build a company.

Founders will have full support from our side, in the form of a partner’s advice, and you will never walk alone, but we expect you to make decisions.

How will TGF help us?

TGF is a genuinely smart money fund. We are seasoned game developers and investors with dozens of years of experience. We have expertise in game design, analytics, monetization, marketing, finance, business, and corporate development, so you can rely on us when you need advice.

If you do not have a company yet, we will help you incorporate and design the optimal structure.

We run regular feedback sessions, provide reviews, connect you with our partners in recruiting, marketing, platforms, legal providers, outsource, etc. But we will not push that. If you do not need our involvement - we will be fine with that.

And ultimately, we will help you raise the following rounds of financing and exit on the best terms.

Why should I raise from VC and TGF in particular?

We believe that VC is a perfect partner for an early-stage game company. There is no string attached. We do not force publishing contracts, do not insist on particular partners or investors, and we do not crave to take control.

The motivation of VC and the Founders are pretty much the same - be flexible, create value, explore best opportunities for the next steps, and fuel the company’s growth without any caps.

TGF is a VC fund with games development and funding experience. We really love and understand games, both premium and free-to-play. We speak the same language with game developers as we are game developers ourselves. We have expertise and connections across the globe that could be super useful for founders.

What should I have to apply, and what is the process?

We would need a company presentation, budget, and a clear vision of what you need to build a successful business. You can find all the necessary templates on this page.

As you have the presentation - please, feel free to send it via the application form on our website or directly to apply@gamesfund.vc.

We will review the materials and will come back to you with initial feedback. We do our best to respond as quickly as possible and respond to all the applications.

We have a compact team, and we are the decision-makers, so we do not have a bureaucracy or complicated approval process.

THE GAMES FUND MAP