NEWS

News and other materials from TGF founders.

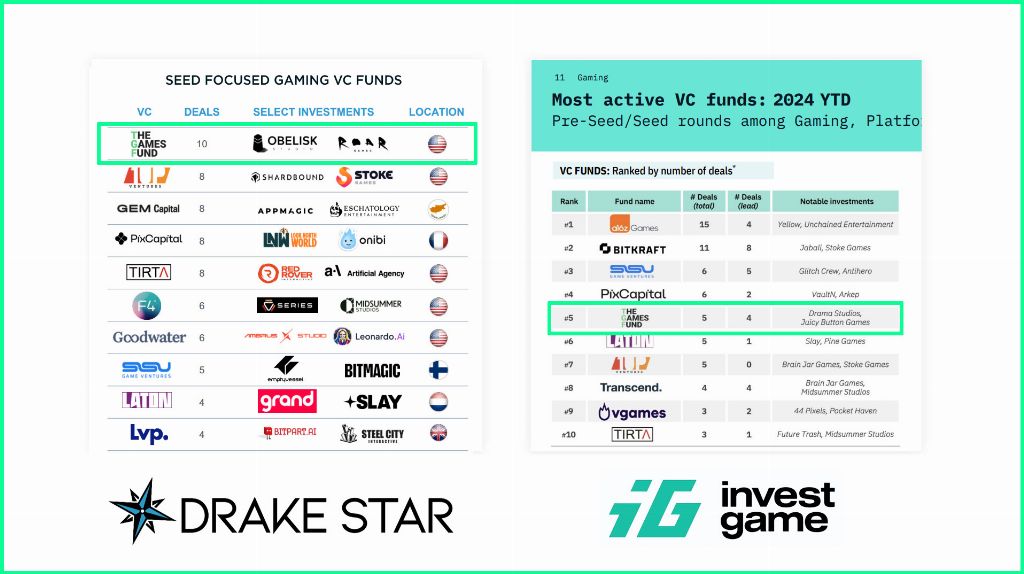

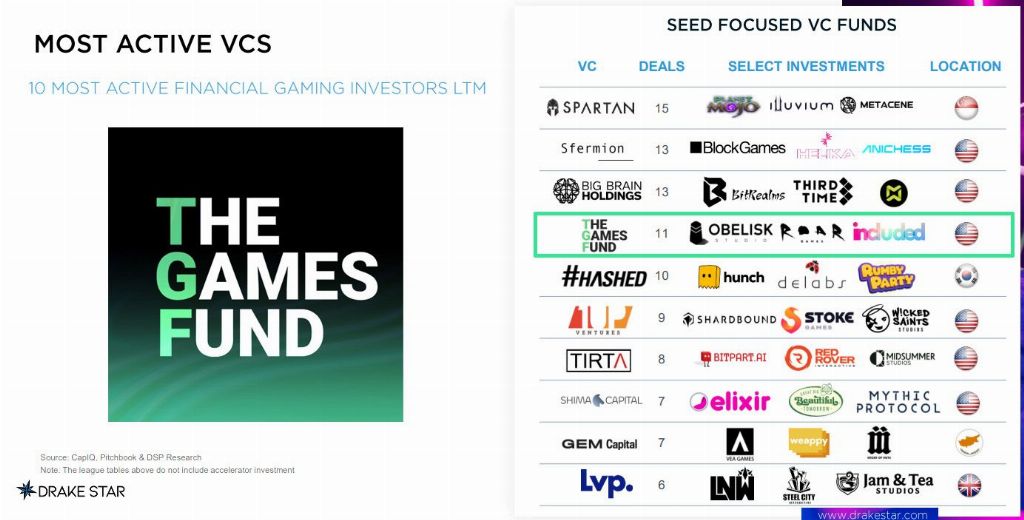

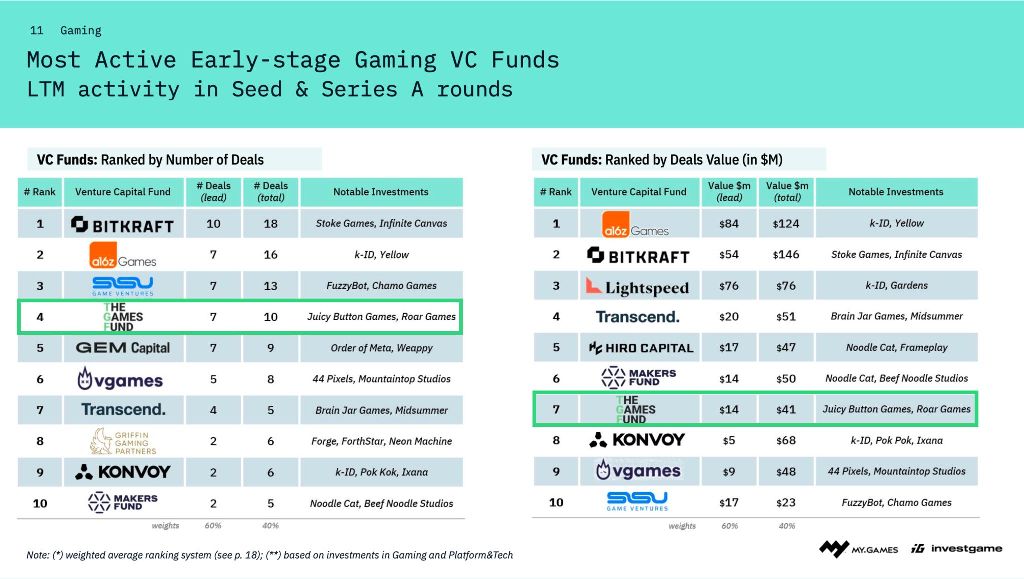

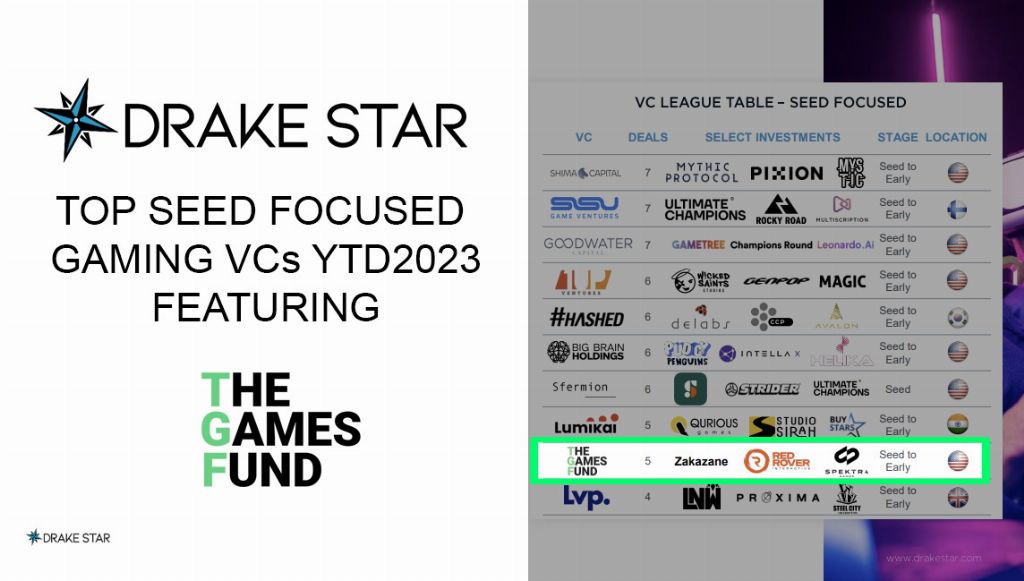

The Games Fund topped the chart of the most active gaming VCs by the two most respected analytical platforms in business - Drakestar Partners and InvestGame. In 2024, we hold the #1 position among early-stage investors and #4 across all stages, which is the best result in our history. Thank you to all our investors, portfolio founders, and teammates!

Dark Passenger is developing the next-gen Multiplayer Action Game inspired by Feudal Japan. With their experience with iconic titles like The Witcher 3 and Cyberpunk 2077, the team aims to create an original IP, unlike anything gamers have seen before.

Our portfolio company, Zakazane, a Warsaw-based studio, has signed an $8 million global publishing deal with NEOWIZ, a leading developer and publisher (Lies of P), to bring their unique Cinematic Noir Detective RPG to the world.

Congratulations to our portfolio company Layer AI for winning the Game Changers 2025 Award! There were 1300 competitors and 25 winners - voted the most innovative gaming and tech companies.

Thank you, Lightspeed, GamesBeat, and the jury!

TGF is named the most active early-stage VC fund in the gaming industry and one of the top funds of 2024 overall! What an incredible achievement for our small but extremely motivated team! Thank you to all the founders and investors who believe in us, and to Drake Star and Investgame for their amazing job reporting on business activity in the games industry!

TGF hosted a 2-day Annual Summit for the fund's portfolio companies, LPs, and partners. This year, more than 200 founders, investors, and top executives from over 90 leading gaming companies joined us in Limassol, Cyprus, making these two days truly unforgettable!

ROAR Games just released an official gameplay trailer of their debut game Tenet of the Spark, an upcoming narrative-led urban brawler adventure game, where you can jump between three worlds, including a gritty NY city, the Viking age, and ancient Aztec civilization. The trailer gives us a peek at gameplay, story, and the three unique worlds. Tenet of the Spark will be available on PC and consoles in 2026.

TGF leads the Seed Round in Drama - developers of the viral sensation Unrecord. Like many, we were hooked by the hyper-realistic trailer for the game Unrecord and puzzled if it was real. The hype was off the charts - the video on IGN Entertainment alone generated over 11 million views, with over 200 million views on YouTube in total, which is mind-blowing for a new IP. It is currently one of the most wishlisted games on Steam.

We partnered with the analytical platform InvestGame to analyze the trends in video game investments over the past five years and reflect on investment dynamics and their underlying causes.

We are excited to announce that our portfolio company, Eschatology Entertainment, has successfully raised a $11.3 million round led by KRAFTON Inc. Series A rounds in our industry are notoriously challenging, so we’re especially pleased to see Eschatology fully funded and ready to deliver their first game. We’re proud to continue supporting and increasing our investment in this amazing studio in this round!

This document explains how The Games Fund makes investment decisions, identifying what we perceive as risks and opportunities. Here we explain our thought process so founders can check their pitches against our framework.

Gaming, once dismissed as a pastime for children, has evolved into a powerhouse in the global entertainment landscape. This transformation from a niche hobby to a leading segment has shifted perceptions and opened up vast investment opportunities in emerging markets.

Following the recent recognition by InvestGame, The Games Fund was once again named the top #4 early-stage gaming VC fund in the world by Drake Star, confirming our status as a leading VC firm in the industry, and #1 by activity among non-web3 funds!

TGF is the leading gaming fund in Europe and the most active player in the Cyprus gaming ecosystem. But we started small and went through a lot in these years to get into the position we are now and unlock what's ahead of us.

InvestGame recently released a new report on investment activity in the video game industry, and The Games Fund has once again ranked among the most active gaming VC funds. This time, as high as 4th place globally!

Juicy Button Games, a new independent games studio co-founded by the creators of Total Battle, Pixel Gun 3D, and Mighty Party, today emerges from stealth with the announcement of a $3 million seed round led by The Games Fund. The investment will fuel Juicy Button Games’ innovative mobile-first 4x strategy game development from its headquarters in Limassol, Cyprus.

Less than a year ago, we led the oversubscribed first round for Red Rover Interactive. Their vision, traction, and innovative approach to game design, management, and development have clearly caught the market's attention. Today, we are thrilled to announce their new, once again oversubscribed, $15 million round led by KRAFTON Inc.

The Games Fund is happy to announce that Roman Ilyutkin joined our party as an Investment Associate! It is a big step forward for TGF, further reinforcing our Cyprus team and our capability in financial and strategic analysis of new opportunities and, even better, supporting our portfolio companies in proper planning and precise execution for sustainable growth.

Welcome, Roman!

TGF invests in ROAR Games, founded by an extremely talented team based in Georgia, New York and Europe. Roar Games is developing 'Tenet of the Spark,' a third-person action title starring a boxer who gains powers through his ancestors. The game features a world-switching mechanic that allows the player to jump between modern settings and the Viking and South American settings of the boxer’s forebears.

Our portfolio company Holmgard just annouced Project L33T, a hardcore first-person PvEvP tactical extraction shooter.

Step into the shoes of an elite L.3.3.T. agency mercenary and engage in high-stakes battles against NPCs and rival players for precious loot. Risk all your gear to collect, secure, and extract Artifacts in this hostile, Anomalies-filled environment, and be prepared to lose it all if you die during the expedition.

Alena Potorskaya has joined The Games Fund as the Head of Legal and will further reinforce our Cyprus team!

For the last 3 consecutive years, Alena has been named the Top Legal Counsel in the Revera Law Group, the leading European law firm, and we are excited to bring our partnership with Alena to the next level and warmly welcome her aboard!

We are excited to announce that The Games Fund has been recognized as one of the 2023 world's top gaming VC funds by InvestGame, confirming the status for the 3rd year in a row and growing in a number of deals position and making us the most active Gaming VC fund in Eastern Europe / Cyprus.

The Games Fund is heading to Riyadh to participate in the NEOM Gaming Accelerator program. We will be happy to meet game developers, investors, and potential business partners interested in the Video Games Industry!

The Games Fund continues to support our old friends in their new venture! $3.3m for an innovative extraction shooter game. Read the full story here!

Great talk by Maria Kochmola, Alexandra Takei and Arseny Alexander on video games industry in Eastern Europe and Cyprus. How is it different from the rest of the world, why we are ultra bullish on this region and why the heck we put Cyprus and Eastern Europe in one sentence?

The Games Fund proudly supports Narwhal, a Cyprus and Eastern European gaming accelerator. This initiative is part of our commitment to fostering the gaming industry in these regions. Narwhal offers an acceleration program with $100,000 for essential operational needs like legal, HR, and talent acquisition. Our involvement in Narwhal underscores The Games Fund's dedication to nurturing emerging gaming ventures and enhancing the gaming ecosystem in these vibrant markets.

Obelisk Studio, an established AAA co-development company with a decade of experience working on household name franchises and independent games, announced today that it has secured $2 million from The Games Fund to build Displacement, an action-horror game that probes the human mind in a scenario of isolation and madness, with fierce and gory close-quarters combat.

Our portfolio company, KEK Entertainment, just released a gameplay trailer of their first game, Armor Attack - a cross-platform-native tactical shooter game. Check it out - it is fire and will be seamlessly playable on any device from PC to Mobile and Consoles.

Investor in TGF is someone like Gordon Freeman, a bit of a scientist, a bit of an action hero. As an Investor, you'll be a crucial part of our investment team, shaping our perspectives on the gaming industry. Your goal will be hunting for investment opportunities ranging from mobile and PC/Console developers to cutting-edge games-related tech companies. Research, identify, negotiate, execute. Click for more info!

The Games Fund team is coming to GStar2023! We will be there from November 15-19th, looking to connect with gaming companies and investors seeking opportunities in emerging regions: Eastern and Central Europe, Cyprus, MENA, Turkey, and Central Asia.

Zakazane is a new Polish game studio full of game veterans, and it has raised a $1 million pre-seed investment.

The founders for Warsaw, Poland-based Zakazane came from bigger Eastern European game companies including CD Projekt Red (maker of Cyberpunk 2077), 11bit Studios (This War of Mine), and GOG.com.

Kek Entertainment has raised $8 million in funding to foster cross-platform gaming experiences across mobile devices, consoles and PCs.

This financial infusion will fuel the development of their flagship title, an unannounced vehicle shooter game merging mobile and PC/Console gamers onto a unified platform.

AI is coming to disrupt game art production whether artists like it or not. And Layer AI is the latest startup to raise $1.8 million to bring AI to game art.

Layer AI raised the round of venture capital funding from investors such as The Games Fund to create what it says is a cutting-edge AI-powered productivity tool.

The Games Fund Summit 2023 was our best event so far! 2 days of insights, 180 brilliant minds, meaningful networking, and amazing atmosphere. Our investors, portfolio founders and partners from all around the world (Turkey, Israel, Ukraine, France, USA, Andorra, UAE, Poland, Finland, Spain, Lithuania, UK, Kazakhstan to name a few!) joined us in celebrating video games!

Drake Star Partners features TGF as one of the Top gaming VC funds in 2023! See the full report for more insights.

We are happy to announce that our portfolio company Made on Earth Games raised $3.25M for the mobile 4X strategy game Everbright. TGF continues to support the company and increase our share.

The TGF team is coming to Cologne to meet with future leaders in games!

Red Rover, a new game studio with offices in Norway and England, has raised $5 million for its multiplayer survival game.

Our first investment in Turkey! Spektra Games is a young but super ambitious and talented team boasting over 40 million downloads for their car simulation games, and this is just the beginning!

The Games Fund is coming to Game Developers Conference 2023 in San Francisco! We will be happy to meet fellow investors and developers and make new friends.

We are happy to announce that InvestGame named The Games Fund among the 15 top VC Gaming Funds worldwide! Make sure to read this super insightful report to catch up with our crazy dynamic industry!

You created your perfect fundraising pitch deck, sent it to multiple VCs, and now they want to talk to you. Fantastic! So, what's happening on an average intro call with a VC, and how to prepare for it?

The Games Fund is coming to D.I.C.E Summit 2023 in Las Vegas! We will be happy to meet fellow investors and developers and make new friends. Our companies are growing, and we are open to co-investment opportunities and strategic partnerships. Want to get in touch? We would love that!

The Games Fund portfolio company Jarvi Games raised $3m for their Seed Round. We are happy to see that our early bet on Jarvi Games pays off! It is so cool to see how the company has evolved from a garage startup of dreamers to a thriving international company, attracting top talent and building the future of entertainment.

Eschatology Entertainment - AAA PC/Console developer founded by Valve and Wargaming veterans working on an unannounced AAA Souls-like FPS game. Eschatology Entertainment is a new generation of creators who dare to bring unique, unconventional experiences to players.

This week TGF Managing Partners Maria Kochmola and Ilya Eremeev would be happy to meet investors and gaming startups at Google Gaming Summit in Dubai!

Over 120 founders and investors from the Video Games Industry, finance, and banking joined us at the TGF Summit in Cyprus! We are grateful to all our friends and partners who flew from all over the world and made this magic possible!

Making mobile games is tricky, especially if you’re a smaller developer. The big game companies take on risk, but they have the tools and staff to handle it. Mad Curve is attempting to fill this niche for developers of any size.

Maria Kochmola, co-founder and Managing Partner of The Games Fund won the Forbes award in Finance and Investment nomination. Forbes 30 under 30 is a global community of bold, innovative young leaders who are changing the course and face of business and society.

The Games Fund holds a sweet 8th place in a world rating of top gaming VC funds by deals activity in Q1 2022 by InvestGame.net!

TGF portfolio company Jarvi Games launched Vice Online in open beta in Brazil and got over 200k downloads in two weeks and counting. More countries coming soon! Vice Online is a multiplayer action sandbox game, extremely fun to play and stream.

The Games fund is happy to announce its new investment - Made on Earth Games, based in Cyprus and Uzbekistan, founded by Yuri Krasilnikov (ex VP at Belka Games) and Alexey Ilin (ex Interaktivny Mult). The company is focused on disrupting the mobile 4x strategy genre.

Thanks to the InvestGame team, for this fantastic (actually the best in class) report on gaming deals activity in 2021! Happy to see The Games Fund among the top Gaming VC funds worldwide.

TGF just announced its new investment - mobile games studio Broyalty, authors of the truly AAA mobile team-fight RPG Broyalty.

New investment by TGF! Kek Entertainment has raised $3 million in pre-seed funding to make mobile action games. Former executives at Pixonic and My.Games founded the Cyprus and Moscow company.

In this episode, Joakim Achrén and Managing Partner of TGF Ilya Eremeev discussing a really interesting story about how Ilya started as a 3D artist and ended up running an early-stage VC fund. In this episode, we also talk about VC funding for the gaming ecosystem in Eastern Europe, how the region is developing, and what Ilya has seen as drivers for success.

Analytical portal InvestGame.net: TGF holds the 9th position among Gaming VC funds by investment activity in H1 2021. See the full report here.

The Games Fund has added $17 million in funding to its game investment coffers, thanks to new support from mobile gaming companies Scopely and Com2Us.

The Games Fund launched in April and quickly exceeded its original target of $30 million. The Moscow and Los Angeles venture firm is still fundraising, but it already announced four investments and expects to close the fundraising at $50 million this fall to ensure continued investments.

The Games Fund is holding the lucky 13th position in the global gaming VC fund rating.

Games Ône measures some 15 professional venture capital firms that specialize in the sector. All were formed within a decade; there were no game-specific VC funds from 1972 to 2009. The assets under management for all 15 firms total $1.577 billion. That number will likely increase with subsequent vintages. Currently, funds are seeking to raise an additional $950 million this year.

TGF wants to be a bridge between international companies and local developers and help them integrate into the global gaming ecosystem. These four investments are typical of what we’ll see from The Games Fund.

“All of them show our strategy of investing in early-stage companies, free-to-play mobile game developers, young developers, based in Eastern Europe,” said Eremeev. “They are all different with some of them working in the casual space and others on the opposite side of the spectrum in midcore and hardcore games.”

Venture capital used to be a cottage industry, with very few investing in tomorrow's products and services. Oh, how times have changed!

While there are more startups than ever, there's also more money chasing them. In this series, we look at the new (or relatively new) VCs in the early stages: seed and Series A.

The Games Fund has raised $50 million for a new game-focused venture capital fund for early-stage investing in both the U.S. and Europe. TGF aims to work with a pool of more than 5,000 established studio and game development teams in Central and Eastern Europe. Portfolio companies will be able to use the connections of the fund’s partners to draw on this often underutilized talent to create games with global appeal.